DYMON ASIA CAPITAL specializes in Asia-focused alternative strategies. Since 2008, we have leveraged deep regional insight to uncover differentiated opportunities for clients.

We have invested in Asia for decades, with direct access to local markets across the region and a proven track record in multi-manager, multi-asset-class strategies.

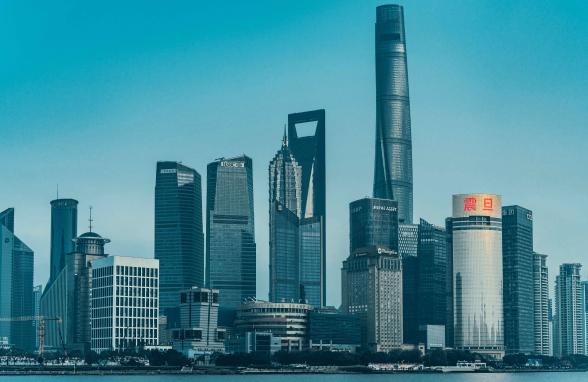

We are embedded in the region’s key cities—ensuring we stay close to the markets, talent, and innovation that shape Asia’s future.

The Multi-Strategy Investment Fund (MSIF) is built to generate consistent, uncorrelated returns with controlled volatility across market cycles

We allocate across a broad range of asset classes and strategies, reducing reliance on market direction.

Our long/short, relative value, and directional strategies are supported by robust risk management frameworks.

We hire managers with a clear edge and differentiated approach, helping them maximise their expertise and potential.

To build a world-class investment platform that empowers exceptional people to deliver outstanding risk-adjusted returns across Asia’s markets.

We foster a culture of teamwork—bringing together diverse perspectives, expertise, and experiences to find the most compelling investment opportunities.

Our diverse suite of fund products from public markets to private markets strategies is designed to meet the varied objectives and risk appetites of our global investor base.

Over the course of my career, I’ve come to realize that my best investments have been in our people.

By empowering every Dymonite to reach their full potential, we will build a stronger firm and deliver lasting value for our clients.

Danny Yong

Founder & Chief Investment Officer

DYMON ASIA CAPITAL (SINGAPORE) PTE. LTD. and its affiliates (collectively, “DYMON ASIA CAPITAL”) have recently observed an increase in reports relating to potential scams, impersonators, fraudulent websites or applications, and messaging platforms that falsely claim to be affiliated with (or operated by) DYMON ASIA CAPITAL or its employees. These parties are impersonating the name, brand and falsely holding themselves out to be associated with DYMON ASIA CAPITAL (or any other similar sounding name) and/or its employees by operating such applications by publishing fraudulent messages over such websites, platforms and applications.

Please note that such use of DYMON ASIA CAPITAL’s name and/or trademarks is without authorization intended to mislead or defraud individuals and DYMON ASIA CAPITAL does not assume any responsibility for any transactions or results that may arise from the aforesaid websites, platforms and applications. Any such communications, solicitations, or outreach should be treated as unauthorized and fraudulent. For further information, please refer to the notice available on our website: https://www.dymonasia.com/notices/

This webpage contains important legal and proprietary information concerning DYMON ASIA CAPITAL and its funds. Before proceeding, please read the following disclaimer statements.

by clicking the “I AGREE” button, you are deemed to be representing and warranting that (1) you have read and understand the information contained in this page and accept the terms and conditions contained herein, (2) the applicable laws and regulations of your jurisdiction allow you to access the information on this webpage, (3) you are duly authorized to access this webpage for the purpose of acquiring information, and (4) you or any other person or entity you represent initiated the discussion, correspondence or other communications with DYMON ASIA CAPITAL or its representatives, which resulted in you requesting access to DYMON ASIA CAPITAL’s website and the information regarding its funds, and none of DYMON ASIA CAPITAL or its representatives at any time directly or indirectly contacted you with respect to the provision of investment advisory services or investment in a DYMON ASIA CAPITAL fund prior to such unsolicited initiation of discussions, correspondence or other communications.

The information on this webpage is not intended for persons located or resident in jurisdictions where the distribution of such information is restricted or unauthorized. No action has been taken to authorize, register or qualify any of the DYMON ASIA CAPITAL funds or otherwise permit a public offering of any DYMON ASIA CAPITAL fund in any jurisdiction, or to permit the distribution of information in relation to any of the DYMON ASIA CAPITAL fund in any jurisdiction.

To the best of its knowledge and belief, DYMON ASIA CAPITAL considers the information contained herein as accurate as at the date of publication. All information and opinions in this webpage are subject to change without notice. No representation or warranty is given, whether express or implied, on the accuracy, adequacy or completeness of information provided in the website or by third parties. The materials in this webpage could include technical inaccuracies or typographical errors, and could become inaccurate as a result of developments occurring after their respective dates. DYMON ASIA CAPITAL undertakes no obligation to maintain updates to such information. Any links to other websites contained within this webpage are for the convenience of the user only and do not constitute an endorsement by DYMON ASIA CAPITAL of these websites. DYMON ASIA CAPITAL is not responsible for the content of other websites referenced in this webpage. Neither DYMON ASIA CAPITAL nor its affiliates and their respective shareholders, directors, officers and employees assume any liabilities in respect of any errors or omissions on this webpage, or any and all responsibility for any direct or consequential loss or damage of any kind resulting directly or indirectly from the use of this webpage. Unless otherwise agreed with DYMON ASIA CAPITAL, any use, disclosure, reproduction, modification or distribution of the contents of this webpage, or any part thereof, is strictly prohibited. DYMON ASIA CAPITAL expressly disclaims any liability, whether in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, punitive or special damages arising out of, or in any way connected with, your access to or use of this website.

This webpage is not an advertisement and is not intended for public use or distribution. This website has been prepared for the purpose of providing general information only without taking account of any particular investor’s objectives, financial situation or needs and does not amount to an investment recommendation. An investor should, before making any investment decision, consider the appropriateness of the information in this website, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. In all cases, anyone proposing to rely on or use the information contained in the website should independently verify and check the accuracy, completeness, reliability and suitability of the information. The information contained in this webpage does not constitute financial, investment, legal, accounting, tax or other professional advice or a solicitation for investment in DYMON ASIA CAPITAL‘s funds, nor does it constitute an offer for sale of interests issued by funds that are managed or advised by DYMON ASIA CAPITAL. Any offer can only be made by the relevant offering documents, together with the relevant subscription agreement, all of which must be read and understood in their entirety, and only in jurisdictions where such an offer is in compliance with relevant laws and regulatory requirements.

Simulations, past and projected performance may not necessarily be indicative of future results. Figures may be taken from sources that are believed to be reliable (but may not necessarily have been independently verified), and such figures should not be relied upon in making investment decisions. DYMON ASIA CAPITAL, its officers and employees do not assume any responsibility for the accuracy or completeness of such information. There is the risk of loss as well as the opportunity for gain when investing in funds managed or advised by DYMON ASIA CAPITAL.

DYMON ASIA CAPITAL (Singapore) Pte. Ltd. holds a capital markets services licence issued by the Monetary Authority of Singapore (“MAS”) for the provision of fund management services to eligible investors and is an exempt financial advisor pursuant to paragraph 20(1)(d) of the Financial Advisers Act (“FAA”). Accordingly, this website and its contents is permitted only for the use of persons who are “institutional investors” or “accredited investors”, each within the meaning provided in the Singapore Securities and Futures Act (Cap.289) (“SFA”); “professional investors” within the meaning provided in the Hong Kong Securities and Futures Ordinance; or the equivalent class of “accredited investor” or “professional client” under the laws of the country or territory of such person. As an “institutional investor” and/or “accredited investor” certain disclosure requirements under the SFA in relation to the contents of this website would not apply to you as a recipient. The products and services described in this website are available to such aforementioned categories of persons only. None of the contents of this website have been approved or endorsed by the MAS or any other global regulator.

Please click “I AGREE” if you confirm and agree that you fall within any of the aforementioned categories.